美国房产资讯报(5月3-5月19日,2023)

发布时间:2023-05-20 11:48:11 来源:网络整理 浏览次数:0

扫描到手机,新闻随时看

扫一扫,用手机看文章

更加方便分享给朋友

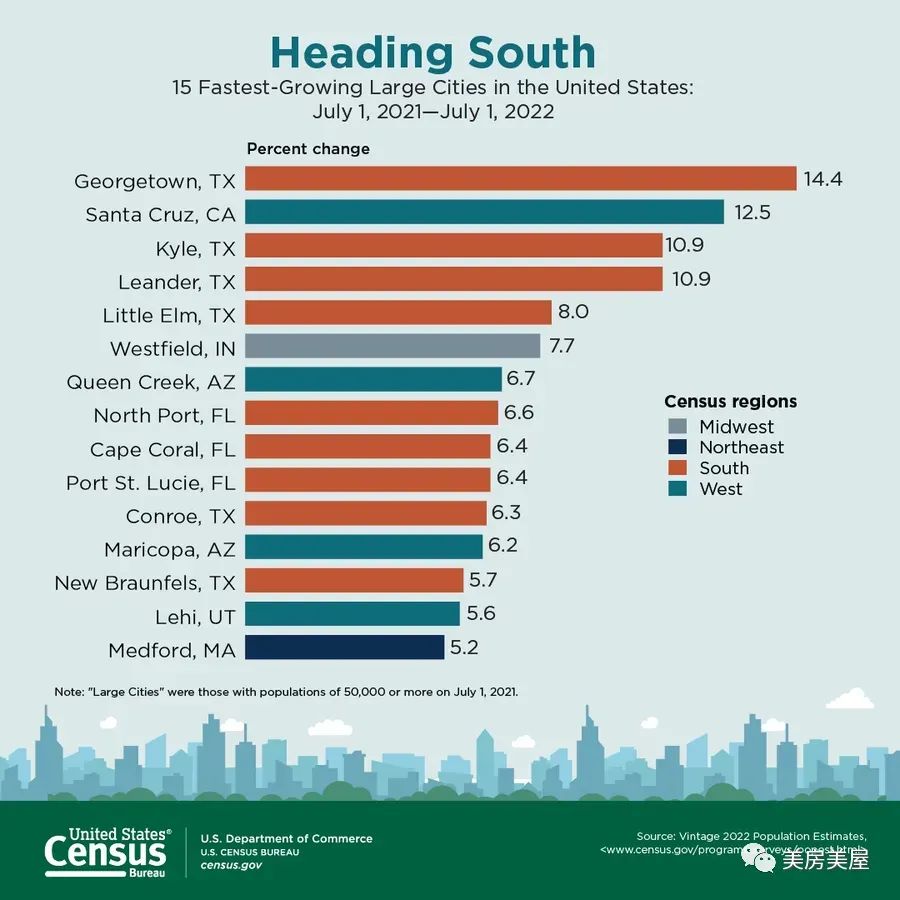

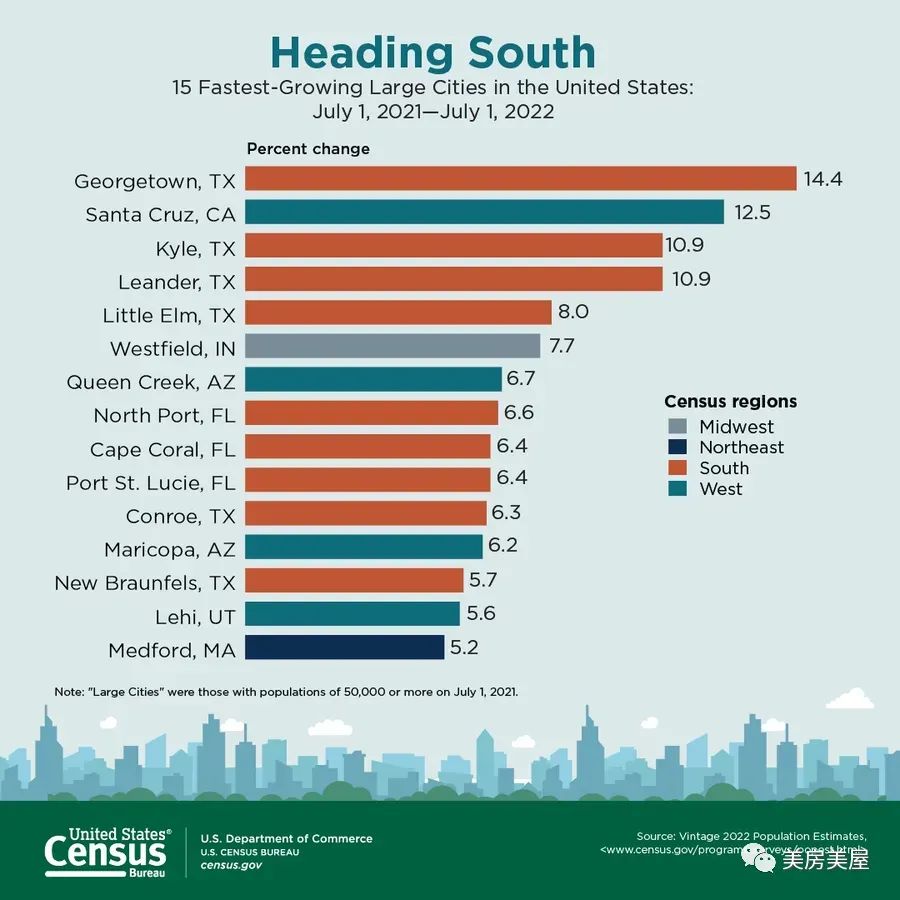

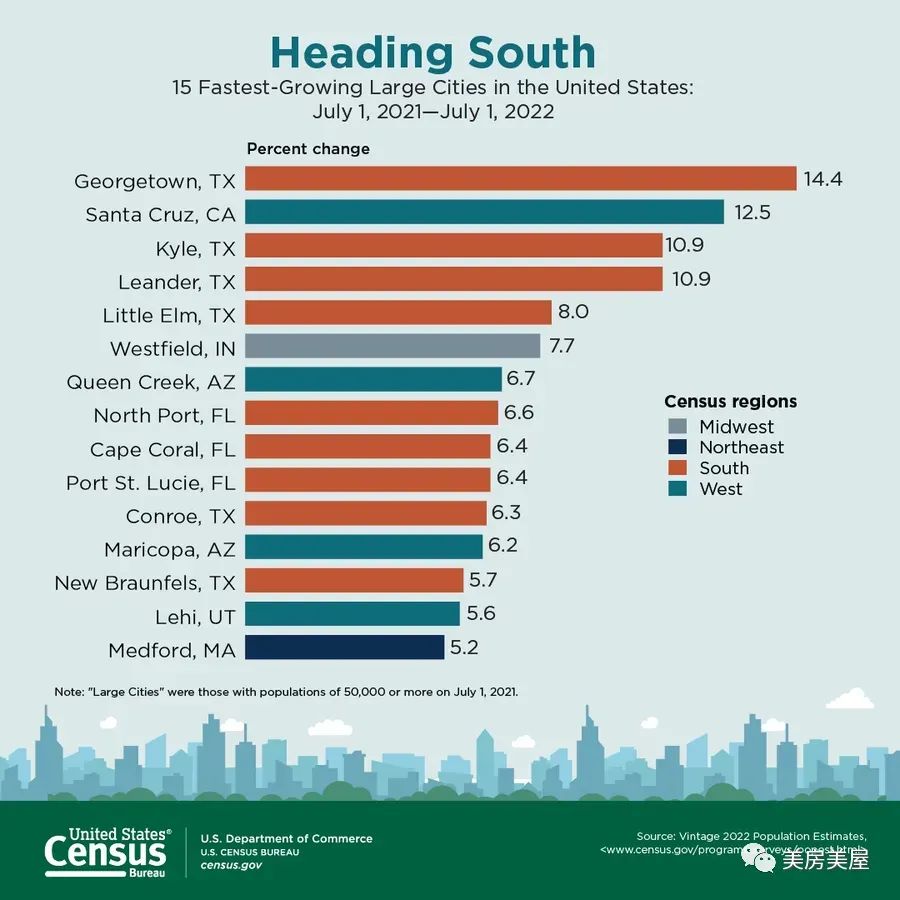

1. This Mass. city is among the top 15 fastest-growing in the U.S.New Census data show that Medford is one of the fastest-growing cities in the country. That city? Medford: home to the Mystic River, Wright’s Park, the Chevalier Theatre, and of course, Tufts University.According to Census data, Medford’s population grew by nearly 10% between 2020 and 2022, from about 60,000 people to about 65,000. “Medford has a great community feel to it, and a type of home for everyone,” he said. “South and East Medford offer slightly more affordable homes, both single-family and multi-occupancy, while West and North are primarily higher-end single-family homes with tree-lined streets that make you forget you live in the city.”In recent years, people are moving out of the Northeast and setting in the South in search of lower taxes, lower living costs, warmer weather, and job opportunities.Despite an overall decrease in Massachusetts’s population for the last several years, the state has a strong economy, with many flourishing industries such as biotech, healthcare, and finance. A March report found that Massachusetts has the highest GDP in the country, which correlates with high economic opportunity and quality of life.

Medford跻身全美人口增长最快城市行列。近年来,为了寻求低税收、低生活成本、暖和的天气和工作机会,人们正在从东北迁出到南方。但是,麻州梅德福(Medford)居然跻身全美发展最快的城市之一(第15)也算是个奇迹。根据人口普查数据,梅德福的人口在 2020 年至 2022 年间增长了近 10%,从大约 60,000 人增加到大约 65,000 人。梅德福是塔夫茨大学所在地,还有美丽的神秘河、赖特公园以及骑士剧院。梅德福南部和东部房屋价格稍低,西部和北部房屋则是高端住宅,街道两旁绿树成荫,让您忘记自己住在城市里。尽管过去几年马萨诸塞州的人口总体减少,但该州经济强劲,拥有许多蓬勃发展的行业,例如生物技术、医疗保健和金融。 3 月份的一份报告发现,马萨诸塞州的 GDP 居全国之首,这与高经济机会和高生活质量相关。2.A U.S. Debt Default Could Send the Housing Market Into a 'Deep Freeze'If the U.S. defaults on its debt, the economic effects could be catastrophic, potentially causing the already struggling housing market to slump further. An analysis released Thursday from the real-estate marketplace Zillow sheds light on just how damaging a potential debt default could be on the housing market. The picture is bleak. Jeff Tucker, a senior economist at Zillow, projected that home sales would plummet, mortgage rates would climb even higher, and buyer housing payments would soar by over 20%. In his report, Tucker stressed that the U.S. has never before defaulted on its debt, and that he believes one is not likely to happen. Still, the U.S. could run out of cash to pay its bills by as early as June, according to recent estimates.如果美国债务违约,经济影响可能是灾难性的,可能导致本已举步维艰的房地产市场进一步下滑。房地产市场 Zillow 周四发布的一项分析揭示了潜在的债务违约对房地产市场的破坏性。Zillow的高级经济学家杰夫塔克预测,房屋销售将直线下降,抵押贷款利率将攀升甚至更高,而买家的住房付款将飙升 20% 以上。不过,他也强调,美国以前从未发生过债务违约,他认为这种情况不太可能发生。 根据最近的估计,美国最早可能在6月用完用来支付账单的现金。(如果为了避免违约,美国可能会错过向联邦工作人员、承包商和供应商或领取社会保障金的人们付款。)3. Existing-Home Sales Faded 3.4% in AprilAccording to NAR, Total existing-home sales1 – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 3.4% from March to a seasonally adjusted annual rate of 4.28 million in April. Year-over-year, sales slumped 23.2% (down from 5.57 million in April 2022).Existing-home sales in the Northeast receded 1.9% from March to an annual rate of 510,000 in April, down 23.9% from April 2022. The median price in the Northeast was $422,700, up 2.8% from the previous year. The median existing-home price3 for all housing types in April was $388,800, a decline of 1.7% from April 2022 ($395,500). Prices rose in the Northeast and Midwest but retreated in the South and West.All-cash sales accounted for 28% of transactions in April, up from 27% in March and 26% the previous year.According to Freddie Mac, the 30-year fixed-rate mortgage(link is external) averaged 6.35% as of May 11. That's down from 6.39% the previous week but up from 5.30% one year ago.根据 NAR 的数据,现房销售总额——包括独栋住宅、联排别墅、公寓和合作公寓在内的已完成交易,较3月份下滑 3.4%,经季节性因素调整后的4月份环比年率为428万套。 销售额同比下降 23.2%(低于 2022 年4月的557 万)。东北地区成屋销售较3月份下降1.9%,4月份环比折年率为 510,000 套,较2022 年4月下降 23.9%。东北地区中位价为 422,700 美元,较上年上涨 2.8%。4 月份所有住房类型的现房价格中位数为 388,800 美元,比 2022 年 4 月(395,500 美元)下降 1.7%。 东北部和中西部的价格上涨,但南部和西部的价格回落。现金全款购买占4月份交易的28%,高于3月份的27%和去年同期的26%。根据房地美的数据,截至5月11日,30 年期固定利率抵押贷款的平均利率为 6.35%。低于前一周的6.39%,但高于一年前的 5.30%。4. Economist on Commercial Real Estate Market ForecastNational Association of Realtors® Chief Economist Lawrence Yun emphasized challenges facing the commercial real estate market brought on by tightening lending policies among many small and regional banks, which have been a key source of commercial loans. Still, due to continuing U.S. job gains, net absorption has been mostly positive nationwide, Yun said, with the apartment, industrial and retail sectors helping to keep the industry relatively stable.In a meeting, Yun said America's apartment sector recorded 116,000 net positive absorptions in the past year, while the industrial and retail sectors added 361 million square feet and 64 million square feet, respectively, over the last 12 months. Office markets, however, saw a reduction in net absorption by 29 million square feet over the same period."The Federal Reserve's aggressive rate hikes have damaged balance sheets for regional and local banks, an important source of commercial real estate loans," he said. Yun estimated that continual rises in rates will in part cause commercial real estate transaction volume to decline by 27% overall in 2023. But "Weaker prices will mean opportunities for those with deeper pockets to get deals done in the months and years ahead.”全美房产经纪人协会首席经济学家Lawrence Yun强调了商业房地产市场面临的挑战,他认为这些挑战是由于许多小型和地区性银行收紧贷款政策所带来的,因为这些银行一直以来都是商业贷款的主要来源。 不过,由于美国就业岗位持续增加,公寓、工业和零售业的净吸纳量大多为正,这有助于保持行业的相对稳定。Yun表示,美国的公寓部门在过去一年所记录的净吸纳量为116,000套,而工业和零售部门在过去12个月分别增加3.61 亿平方英尺和 6400万平方英尺。 然而,写字楼市场同期的净吸纳量则减少了2900万平方英尺。“美联储激进的加息破坏了区域和地方银行的资产负债表,这是商业房地产贷款的重要来源,”他说。 据他估计,利率的持续上涨将在一定程度上导致 2023年商业房地产交易量整体下降27%。但“价格疲软将意味着那些财力雄厚的人有机会在未来几个月和几年内完成交易。”

凡注明"来源:安吉房产网"的稿件为本网独家原创稿件,引用或转载请注明出处。

【编辑:admin】

关键词: